Exhaustion & Logic

Image credit: msn.com

“If we go by the book, like Lt. Saavik, hours would seem like days.” - Captain Spock speaking to Admiral Kirk.

Over the first months of 2025, with the deluge of news, I am reminded of this line from my favourite Star Trek movie - Star Trek II: The Wrath of Khan. Spock is communicating a message to Kirk in code, as their conversation is being monitored. In order to confuse the enemy, they transpose the time it would take to repair the Enterprise and misdirect Khan. When reading the news, keeping up with the flow of data and speculation as to how the news will affect politics, the economy (domestically and abroad) and ultimately, our investments, hours do indeed seem like days. Months feel like years.

This brings me to our collective exhaustion. Everyone is tired and confused by the daily onslaught of headlines. Coming off of the firm’s weekly technical market call at the beginning of April, there were a number of data points the team was watching. The Russell 2000 was supposed to be the beneficiary of the “Trump Bump” but has seen significant selling pressure. The Put/Call ratio is neutral, as are market internals, an indication that there is more downside potential in the market. With capital leaving U.S. markets, we are seeing more interest in international markets as well as Canadian energy, utilities and life-Co’s. Remember that data is changing fast, and the U.S. president’s whims (or blood-sugar level) are swinging wildly. Trust in the U.S. administration is being eroded and might take years to recover, and U.S. valuations are still expensive compared to international equities. Some of the information, as of this writing, could also look dated by the time you read this.

Because information can change very quickly, we have to step back and look at longer-term trends. In last quarter’s article, we spoke of the different stages of the business cycle and explained that we thought we were in the slowdown phase of the cycle. It’s looking very likely that we’re moving into phase four, contraction. There are three possibilities for the S&P 500 from the March 31st technical call with Neil Linsdell, our Head of Investment Strategy, and Javed Mirza, our Quantitative Strategist:

- Rally to Recent Highs, 15% probability

- 4-Year Cycle Reset (Secular Bull), 70% probability

- 4-Year Cycle Reset (Secular Bear), 15% probability

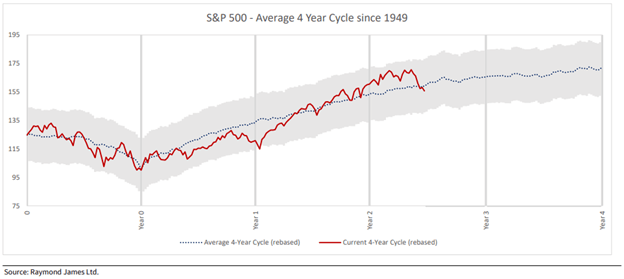

The above chart illustrates the average four-year cycle since 1949, with the red line showing where we are as of March 31; the dotted line is the average. When looking at what could happen over the next 6 – 18 months, this is one of our guides. Phase 3 (slowdown) can take approximately 12 months to play out, while phase 4 (bear market) on average takes 3-6 months to hit bottom. This means that if we’re in the beginning of phase 4, it might be rough between now to September.

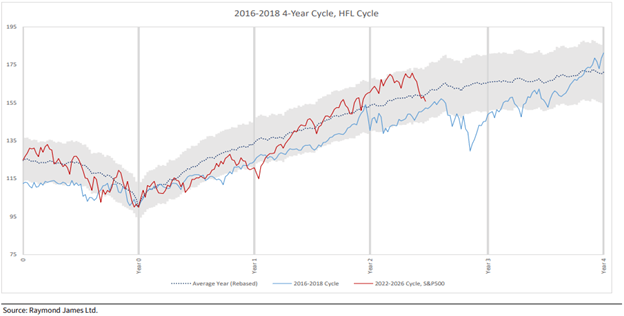

The second chart shows the last four-year cycle rotation (line in blue). Javed points out that where the blue line drops, late in year 2, was during the last U.S.-China trade war, known as the Christmas Eve massacre. The sell-off lasted from October to December 2018. The red line shows where the market is, as of March 31st, and there is a resemblance in the pattern, which could indicate further selling pressure.

This brings me to logic. I have been in communication with many clients, and conversations that normally take five or ten minutes, now take thirty minutes or more. We talk about the news and how this might ultimately affect our investments and their savings. I’m asked continually what my predictions are for markets and specific investments. What I remind people is that, when you are unsure of the moment, focus on the long term. In relation to investing, I like to begin at basic fundamentals. Logically, people still need to eat, need shelter and need electricity. We will still travel, and we need to communicate. From these basic foundational needs, we can begin to build upward to what kinds of companies allow us to invest in these needs. We then, again, narrow the funnel to investments that can weather uncertainty the best, over the long term.

Logic dictates that there are going to be opportunities for investors. Once we’re through the contraction, there will be excellent valuations and cause for excitement, but right now, it’s about protecting our capital. It is very easy to get distracted by noise, while looking for a signal, and that signal may not show itself in an obvious way. This is why being well-diversified in various markets, industries and investments will save a great deal of pain to investors and allow us to take advantage.

Warren Buffett wrote in his 2017 letter to shareholders saying, “When major declines occur, however, they offer extraordinary opportunities… That’s the time to heed these lines from Kipling’s If:

‘If you can keep your head when all about you are losing theirs…

If you can wait and not be tired by waiting…

If you can think… and not make thoughts your aim…

If you can trust yourself when all men doubt you…

Yours is the Earth and everything that’s in it.’”

This newsletter has been prepared by Stephen Maser of Raymond James Ltd. (“RJL”). It expresses the opinions of the writer, and not necessarily those of RJL. Statistics, factual data and other information are from sources believed to be reliable but accuracy cannot be guaranteed. It is furnished on the basis and understanding that RJL is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. RJL, its officers, directors, employees and their families may from time to time invest in the securities discussed in this newsletter. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to. It is intended for distribution only in those jurisdictions where RJL is registered as a dealer in securities. Distribution or dissemination of this newsletter in any other jurisdiction is strictly prohibited. This newsletter is not intended for nor should it be distributed to any person residing in the USA. Raymond James Limited is a Member Canadian Investor Protection Fund. Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Raymond James (USA) Ltd., member FINRA/SIPC.