A new standard of portfolio management

With over 100 years of combined industry experience, the professionals at Aura Wealth Management (AWM) have created a system of portfolio management, which they feel is unmatched in the industry. Using a fundamentalist approach to securities selection with a technical overlay in rebalancing, the objective is to give your portfolio the flexibility needed during each stage of The Financial Life Cycle.

Our approach to portfolio construction is based on these priorities in this order.

- Client Risk Analysis

- Security Selection

- Tax Efficiency

While this is the order of priority, your success is determined on a highly disciplined buy, hold and re-balance philosophy. Through this process and regular quarterly reviews, we can ensure our clients’ portfolios are truly bespoke. No one is ignored and your investment portfolio is unique to you and your circumstances.

Our process has been independently reviewed, and outcomes are directly related to our priority approach. The data below shows what this method has yielded based upon our diversification and rebalancing approach to portfolio management.

Performance Evaluation

The data presented below was analyzed by an independent third party and is based on our portfolio constituents as well as how we manage market dynamics and risk. The information is meant to give a general idea of our results from a more technical perspective.

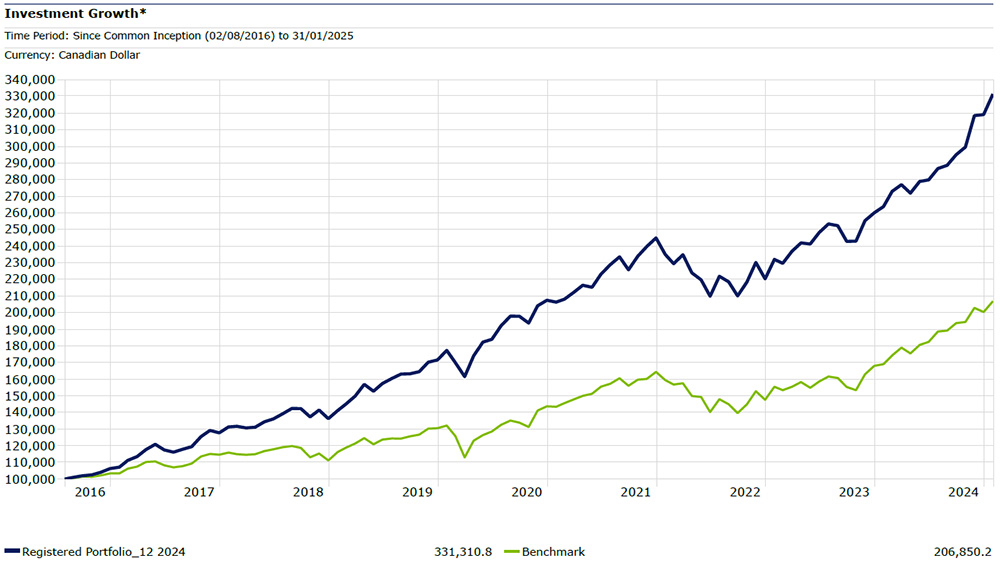

Registered Portfolio Example

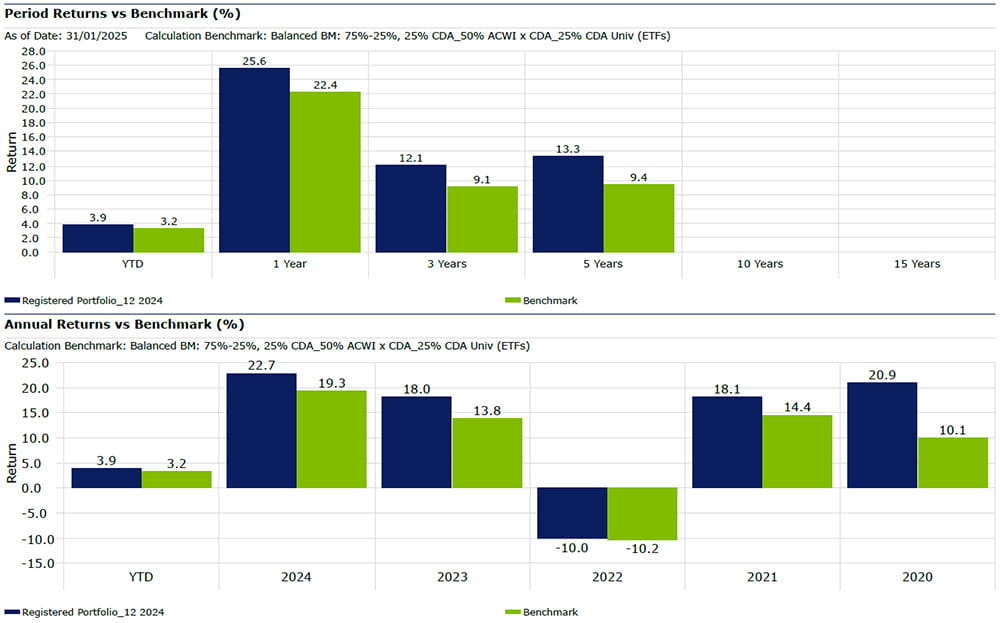

Performance Relative to Benchmark

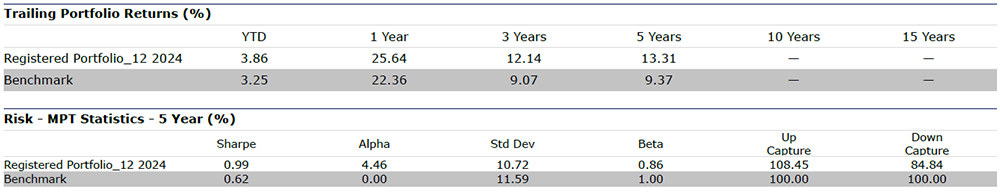

Registered Portfolio Return and Risk Overview

The analysis also showed the historical performance for our model outperformed the benchmark (BM) with a lower level of risk over the last five years. This has led to better than BM risk-adjusted performance. With a higher Sharpe ratio, a positive Alpha and lower Beta, AWM’s model participated in more than 106 per cent of the BM’s upside with only 80 per cent of the downside.

The third party analysis shows the Aura Model Portfolio tilts towards a large-cap blend of Growth and Value investment styles with an overweight bias toward the former.

These results are a combination of individual security selection and use of third party portfolio managers that have access to markets we don’t or possess expertise we do not have.

-

The make-up of the Aura Wealth Management model portfolio is designed for scale by using a concentrated number of investment products with bespoke customization based on who you are as an individual. Whether you are starting out as a new investor or you’ve been building your wealth for decades, your portfolio is unique to you.

-

Once someone becomes a client, they are given ongoing, detailed quarterly reviews with detailed data of their investments, detailed market commentary and easy to understand charting of rate of return. We give our clients as much information as they could possibly need written in a way that allows them to find the information that’s most important.

Our team instructs clients how to read their information, and client education is ongoing.

-

For a more detailed description of what we do, how we do it and how we can help you meet your financial objectives, please reach out to book an appointment either in person or virtually.

The Investment Growth chart illustrates an initial investment of $100,000 and is based on the historical annual compounded total rates of return of the sample portfolio and/or benchmark. The Portfolio was constructed using the asset allocation selected. Returns include changes in share/unit value and reinvestment of all dividends/distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable that would have reduced returns.

Returns are for series shown and calculated at net asset value (without sales charges). If sales charge had been included, returns would have been lower. They take into account fee waivers and/or expense reimbursements, as applicable. Where the series of the fund is not indicated, the series is generally the initial series offered when the fund was launched and may not be the most appropriate series for comparison. Source: Morningstar Direct. Index and Morningstar category average based on the first fund selected.

Performance data represents past performance, which does not guarantee future results. Investment return and principal value will change with market conditions and an investor may have a gain or loss when they sell their securities. Please visit franklintempleton.ca for *Franklin Templeton Funds' most recent month-end performance. For other fund families, please visit the respective fund family's website for most recent month-end performance.

This information has been prepared by Stephen Maser, Joe Howorko, Dale Krushel & Amanda Krushel of Raymond James Ltd. (“RJL”). It expresses the opinions of the writer, and not necessarily those of RJL. Statistics, factual data and other information are from sources believed to be reliable but accuracy cannot be guaranteed. It is furnished on the basis and understanding that RJL is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. RJL, its officers, directors, employees and their families may from time to time invest in the securities discussed in this newsletter. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to. It is intended for distribution only in those jurisdictions where RJL is registered as a dealer in securities. Distribution or dissemination of this newsletter in any other jurisdiction is strictly prohibited. This newsletter is not intended for nor should it be distributed to any person residing in the USA. Raymond James Limited is a Member Canadian Investor Protection Fund. Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Raymond James (USA) Ltd., member FINRA/SIPC.