U.S. Elections & the Markets, Redux

It was 12 years ago I wrote my first article, and it was about the effect that U.S. elections have on the investment markets. This year, in what many believe is going to be the most important U.S. election in our lifetimes (again) I feel it is important to revisit this topic and see if anything has changed in regard to the markets and elections. It was interesting to go back and look at what I wrote, seeing how the data has evolved and give context to how your wealth might be affected depending on the election result. I also felt it was good to add meat to the bone as my first article was pretty basic. The data holds up well enough but there was nuance missing, especially for a topic so complex. I’m not going to bury the lead; it typically makes very little difference who’s in power when it comes to market performance. While this still holds true let’s dig deeper into what history has to show us.

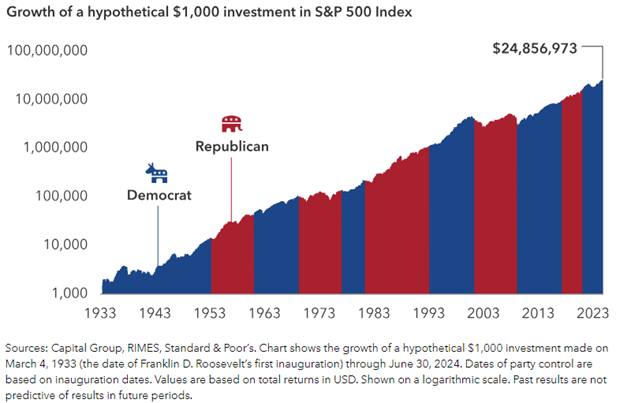

Brian Levitt, Global Market Strategist at Invesco has said “People care about elections. Markets don’t”. In most cases, it is monetary policy that will drive market results as compared to who is in the White House. So, who would benefit the most by choosing sides in an election with their money? The chart below breaks down how “partisan” investors have fared compared to being politically agnostic and just staying invested. The results are stark.

I would caution those who look at this and focus on the “partisan” result. While the difference is fairly large between administrations, it’s even larger if you’re choosing a side. As well, our personal biases can be blinding when cherry-picking data in this way. When looking at the growth of the S&P 500 most have seen the growth over time, but it’s been far less if investors move in and out of the market depending on if the president has been Democrat or Republican.

T. Rowe Price points out that we also have to know the limit on the data we are provided. There have been elections that have had major economic events during election years. They use examples such as the Great Depression (1932), World War II (1940 and 1944), the tech wreck (2000), the global financial crisis (2008) and COVID-19 (2020). It should be noted that T. Rowe Price’s white paper data only goes back to 1927 and 24 presidential elections.

This summer, Fidelity Investments came out with five takeaways during elections years:

1. Historically, U.S. markets have generally risen in election years.

2. Down-ballot races may be highly consequential.

3. Betting on specific policy or sector impacts can be highly risky.

4. Markets are nonpartisan.

5. Investors should focus on fundamentals and stick with their plans.

At risk of sounding repetitive, we as investors can’t think we can time the market or pretend we know the future. You can pick almost any point on the chart below, think you can leave the market because the presidential candidate you didn’t like won, be convinced we were all going broke because of political reasons but you would have almost certainly missed out on significant gains.

The deeper you dig into the data, you end up finding contradictions depending on when the writer has chosen to begin tracking, political bias and general confusion to try and come up with a satisfying conclusion. There is also a hope that we will find something that someone else has missed or that we have a unique insight that the multitudes of those who came before couldn’t find.

The articles we write for clients are, in their essence is to reinforce what we already know and what we’ve said before; manage risk and don’t try timing the market. This repetition in intentional as it’s easy to get caught up in the news cycle telling you that “this time it’s different”. When it comes to the markets, this time is likely like the last time.

This newsletter has been prepared by Stephen Maser, Dale Krushel & Amanda Krushel of Raymond James Ltd. (“RJL”). It expresses the opinions of the writer, and not necessarily those of RJL. Statistics, factual data and other information are from sources believed to be reliable but accuracy cannot be guaranteed. It is furnished on the basis and understanding that RJL is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. RJL, its officers, directors, employees and their families may from time to time invest in the securities discussed in this newsletter. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to. It is intended for distribution only in those jurisdictions where RJL is registered as a dealer in securities. Distribution or dissemination of this newsletter in any other jurisdiction is strictly prohibited. This newsletter is not intended for nor should it be distributed to any person residing in the USA. Raymond James Limited is a Member Canadian Investor Protection Fund. Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Raymond James (USA) Ltd., member FINRA/SIPC.